The Section 179 Tax Code can help refresh your hardware and software

Has your server been chugging along for years without any end in sight? Is your organization overdue for a software refresh? Section 179 of the Federal Tax Code can help.

If you’ve been on the fence about investing in new hardware or software for your business, and you haven’t thought about the tax codes that can give you a leg up, hopefully this will help you to a decision on aging hardware and software.

What is Section 179?

Section 179 allows you to “choose to treat the cost of certain property as an expense and deduct it in the year the property is placed in service instead of depreciating it over several years”. This is an amazing incentive for a small business to invest in itself and its future. Thanks, IRS!

The value of this is great, but what qualifies? What can be categorized as IRS §179 property?

What Equipment Qualifies?

Any equipment or machines that are purchased for business use and put into use between January 1, 2016 and December 31, 2021 qualifies as IRS §179 property. So that could be computers, printers, servers, network devices, software, even office furniture.

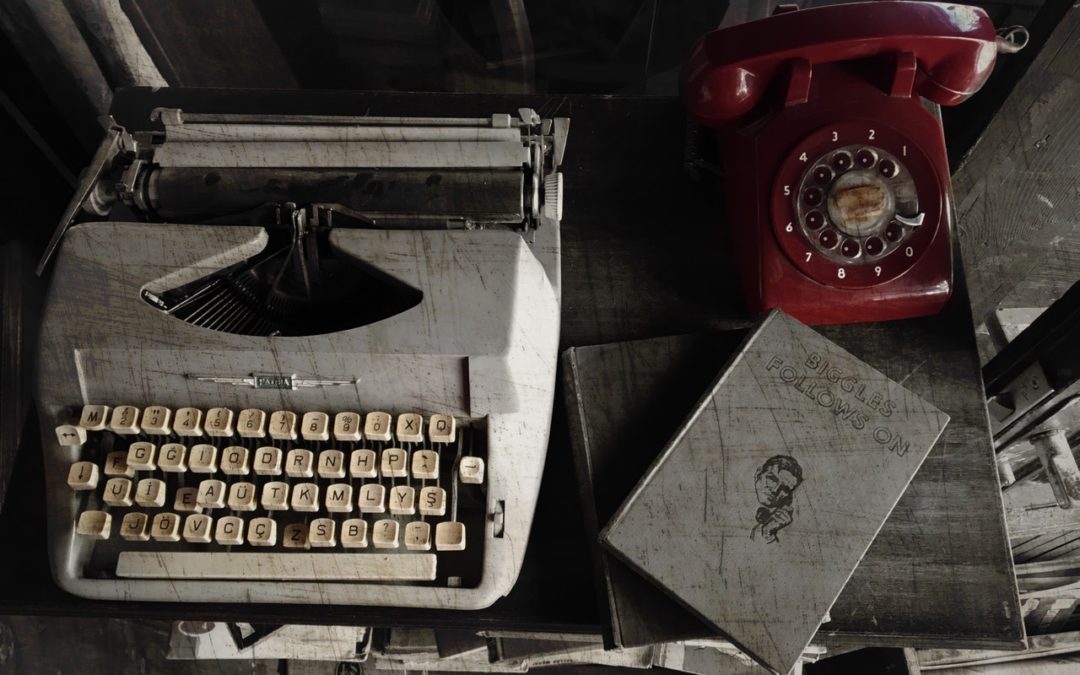

Computers don’t last forever, but what does a technology lifespan really look like? When is a good time to invest in new IT equipment?

How long does equipment generally last?

As a general rule, a good server will run like a well-oiled machine for 3-5 years, provided that the proper proactive monitoring and maintenance occurs, but performance issues typically begin around the 5+ year mark. After that, the cost of keeping these machines running well invariably becomes greater than the cost of upgrade. Desktop computers slow after about 3 years and die at around 5; software upgrades will likely have slowed performance to a crawl by then. Laptops, depending on how they’ve been used, can start to show signs of wear and tear as early as a couple of years after purchase, and they generally stop being appropriate for business use at about age 4.

Increase Employee Performance

One costly factor that tends to be swept under the rug when considering an IT upgrade is employee performance. A productive employee provides service to existing clients or brings in new customers; they keep your business in the black. An employee with an old, tired computer is a cost to your business. With a new workstation, maybe they wouldn’t be sitting idly for 10 minutes while their desktops boot up.

But what kind of software qualifies as IRS §179 property? “Any program designed to cause a computer to perform a desired function” (source: www.section179.org). So The Last Guardian, might be a stretch, but a new operating system or business application? You bet!

Are we trying to push you into purchasing new hardware or software? Absolutely not. Responza only advocates for the acquisition of new equipment when it meets your business needs. Section 179 just happens to sweeten the “when” part of the deal.

Responza will definitely be taking advantage of IRS §179, and we’d love to help your business do the same, but we are by no means qualified CPAs. Talk to your financial advisor or tax preparer concerning what is and is not deductible and whether it makes sense for you to purchase items that qualify as Section 179 property.

Recent Comments